Tu carrito

Noticias de Empresa

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

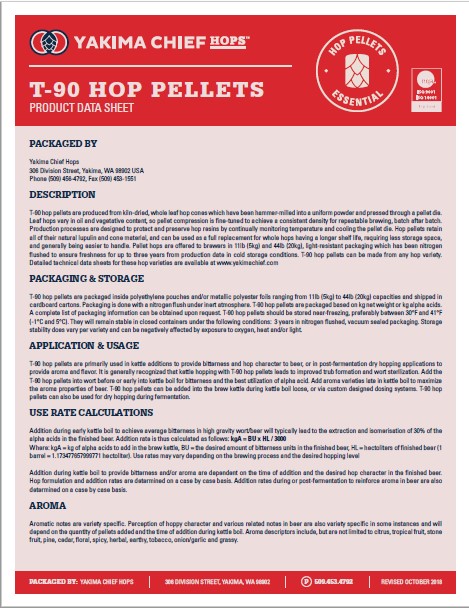

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet

-

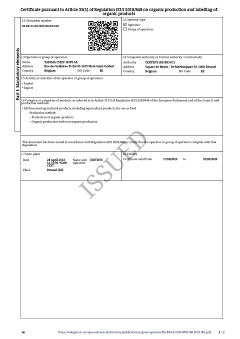

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

-

Barth Haas Hops: EU Food Safety Declaration 2022

Barth Haas Hops: EU Food Safety Declaration 2022

Sugerencia

USA, OR: Craft Brew Alliance reports Q2 results

USA, OR: Craft Brew Alliance reports Q2 results

Craft Brew Alliance (CBA) on August 2 reported second quarter earnings results, which were highlighted by a 9 percent increase in Kona depletions.

But Kona’s continued depletion growth – which CBA executives have repeatedly touted as a mainstream, crossover brand that sources volumes from the craft and import segments – couldn’t completely offset ongoing declines of Widmer Brothers and Redhook.

Widmer depletions dipped 13 percent during Q2, while Redhook depletions declined 24 percent, the company noted in an SEC filing. Those declines contributed to portfolio-wide depletion decreases of 2 percent. Year-to-date depletions, meanwhile, were down 1 percent through June 30, the company added.

Portfolio-wide shipments also decreased 8 percent during the quarter and 4 percent year-to-date, while net sales decreased 3 percent during the quarter, to $60.6 million. However, the company’s year-to-date sales were still up 3 percent, to $104.9 million, something CBA attributed to shipment growth for its Kona and partner brands.

“Our year-to-date performance is largely in line with expectations,” CFO Joe Vanderstelt said via a press release. “We believe our plans for the balance of the year ensure CBA is well positioned to deliver on our objectives for 2017.”

For his part, CEO Andy Thomas said the company’s ability to grow sales of Kona, at a time when competition within the craft segment has reached an all-time high, was “impressive.”

“In my nearly 25 years in the beer business, I have seen the industry evolve and adapt countless times but nothing has come close to the competition, complexity and consumer-driven change facing our market today,” he said via the release. “Against this backdrop, CBA’s ability to sustain robust growth for Kona, accelerate our partnership strategy, and make significant progress evolving our brewing footprint while stabilizing inventory levels is not just impressive, but highly encouraging as well.”

Regresar