Tu carrito

Noticias de Empresa

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

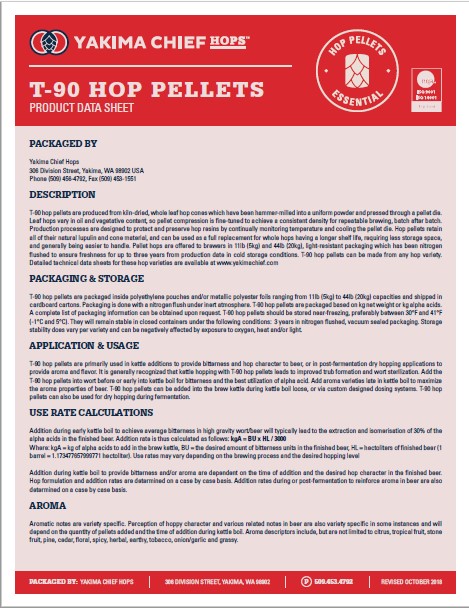

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet

-

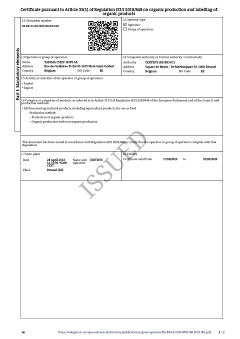

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

-

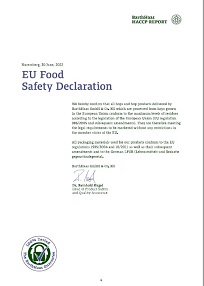

Barth Haas Hops: EU Food Safety Declaration 2022

Barth Haas Hops: EU Food Safety Declaration 2022

Sugerencia

World: Global beer consumption estimated to have dropped by 1.8% last year

World: Global beer consumption estimated to have dropped by 1.8% last year

A new report finds that global alcohol consumption is on the decline, with notably steep drops observed in the consumption of beer and cider, CTV News reported on June 1.

According to the latest figures out of the International Wine and Spirits Research group out of the U.K., the global market for alcoholic drinks shrunk by -1.3 per cent in 2016. Compared to the average rate of -0.3 per cent in the previous five years, the decline is increasing at a faster rate than previously projected, analysts say.

The main reasons for the drop? A faster decline in beer consumption, a reversal of trends for cider and slowing growth for mixed drinks.

After years of enjoying double-digit growth in the U.S., it seems cider's 15 minutes of fame is up, for example, with volumes collapsing -15 percent. The same is true in South Africa, where cider has fallen out of popularity after years of double-digit growth.

Globally, the consumption of cider shrunk by -1.5 per cent last year. The story is similar for beer, with consumption dropping -1.8 per cent in 2016, compared to the five-year average of -0.6 per cent.

The accelerated decline is traced back to three major markets where beer consumption suffered steep drops. In China, consumption dropped -4.2 per cent; Brazil -5.3 per cent; and Russia -7.8 per cent.

In the category of spirits, vodka consumption dropped -4.3 per cent, while volumes of tequila, gin and whisky increased between 2 and 5 per cent. Wine consumption was flat, with a modest increased consumption of sparkling wine at 1.8 percent.

Despite the downturn in 2016, analysts predict that alcohol consumption will rise modestly by 0.8 per cent until 2021, thanks in part to whisky, one of the main growth drivers.

Likewise, mixed drinks, sparkling wine and beer - which is forecast to grow in Asian and sub-Saharan African markets - are expected to rise over the next few years.

Regresar