Tu carrito

Noticias de Empresa

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

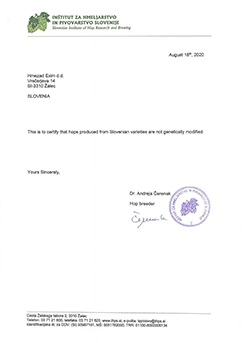

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

-

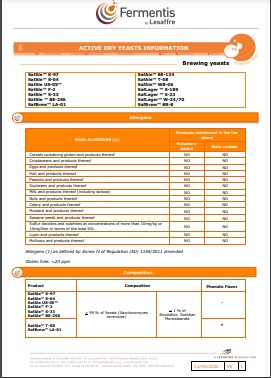

Fermentis - Brewing Yeasts Information 2023

Fermentis - Brewing Yeasts Information 2023

-

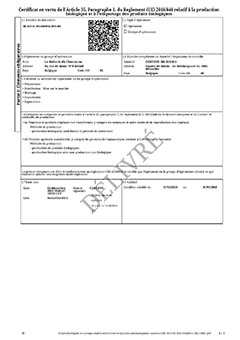

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Sugerencia

Russia: Carlsberg warns beer market will shrink at least 5% this year

Russia: Carlsberg warns beer market will shrink at least 5% this year

Carlsberg A/S warned the Russian beer market will shrink at least 5 percent this year, stunting the Tuborg maker’s growth prospects as a ban on large bottles takes hold.

The market, which was the source of a sixth of last year’s operating profit, is declining after Russia prohibited selling beer in 1.5 litre plastic bottles in January, Chief Executive Officer Cees ’t Hart said on a call with reporters on February 8. The stock fell as much as 3.8 percent in Copenhagen, the steepest intraday decline in almost six months, even as Carlsberg forecast higher earnings.

“We’re depending on consumer confidence, and we don’t see those figures changing at this point in time,” the CEO told analysts. “We are cautious - not pessimistic, not optimistic - but I think just realistic.”

Carlsberg’s Russian business, built upon the biggest acquisition in the Danish brewer’s history, generated almost half of operating profits seven years ago. But a series of shocks to the market - including plunging oil prices, Western sanctions, recession and higher beer taxes - has diminished the weight of that market in the brewer’s earnings. The Danish company sells about a third of the beer consumed in Russia under brands such as Baltika.

Carlsberg plans to increase prices roughly in line with inflation in the country this year and smaller bottles have slightly higher margins, ’t Hart said. The company said the brewing industry is in talks with the Russian government in the hope of easing its stance.

“Discussions are good at a very high level,” the CEO said. “At this moment in time, we’re slightly more optimistic, but again, that can change almost every minute in Russia.”

Some analysts expect improving prospects for the Russian economy may help Carlsberg. Frans Hoyer, an analyst at Jyske Bank, has said the rebound in the ruble and the possibility of U.S. President Donald Trump easing sanctions on the country may play in the brewer’s favor.

“Day by day, the news from the Trump administration is different in how it concerns Putin and Russia,” making it difficult to predict an easing of sanctions and the potential impact on consumer confidence, ’t Hart said in an interview.

Operating profit will rise by a mid-single-digit percentage on an organic basis after rising 5 percent last year, the Copenhagen-based brewer also said on February 8. The company forecast currency shifts will boost earnings by 350 million kroner ($50 million) in 2017.

“From a conservative management team, guidance of a mid-single digit increase in organic profit is as good as one could hope for at this stage,” Eamonn Ferry, an analyst at Exane BNP Paribas, said in a note to investors. 2017 is the “delivery year.”

Operating profit of 8.25 billion kroner in 2016 missed analysts’ estimates of 8.29 billion kroner.

Regresar