Il tuo carrello

Il tuo carrello è vuoto

Notizie Aziendali

E-Malt news

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

I nostri malti

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Tappi 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

-

Crown Caps 26 mm TFS-PVC Free, Nero col. 2217 Beer Season (10000/box)*

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Nero col. 2217 Beer Season (10000/box)*

Aggiungi al carrello

Ricette per birra

Certificati

-

Malt Kosher Certificate July 2025-June 2026

Malt Kosher Certificate July 2025-June 2026

-

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

-

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

-

Malt Attestation of Conformity for Mycotoxins and Heavy Metals 2024 (ENG)

Malt Attestation of Conformity for Mycotoxins and Heavy Metals 2024 (ENG)

-

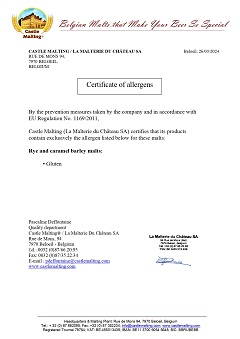

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Suggerimento

CASTLE MALTING NEWS in partnership with www.e-malt.com

21 October, 2003

AmBev, Brazil's largest brewer, has seen its share of its domestic market fall from 70% to 66% between June and September this year, according to Dow Jones Newswires, who said it was culled, but not divulged, from the AC Nielsen group. AmBev's Skol, Brahma and Antartica brands accounted for 32.1%, 20.6% and 13.4%, respectively, of all beer sales in September, the report said. By comparison, in June, Skol, Brahma and Antartica accounted for 34.2%, 21.9%, and 14.1% of the market, respectively, according to Nielsen numbers collected by Brazil's National Brewers' Association, Sindcerv. The brand Schincariol, the country's fifth largest brand, picked up the largest share of AmBev's loss.

Torna

This article is courtesy of E-malt.com, the global information source for the brewing and malting industry professionals.

The bi-weekly E-malt.com Newsletters feature latest industry news, statistics in graphs and tables, world barley and malt prices, and other relevant information. Click here to get full access to E-malt.com. If you are a Castle Malting client, you can get free access to E-malt.com website and publications. Contact us for more information at marketing@castlemalting.com .