Tu carrito

Noticias de Empresa

E-Malt news

Kenya: Diageo to sell its stake in East African Breweries to Asahi Group

World: Global hop harvest lower this year, Barth Haas say

USA, NM: Two Bosque Brewing locations in Albuquerque closing their doors

World: Global hop acreage down 5% in 2025

Nuestras maltas

-

CHÂTEAU CARA GOLD NATURE® (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA GOLD NATURE® (MALTA ORGÁNICA)

Añadir al carrito

-

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTA ORGÁNICA)

Añadir al carrito

-

CHÂTEAU CARA HONEY NATURE (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA HONEY NATURE (MALTA ORGÁNICA)

Añadir al carrito

-

MALT CHÂTEAU OAT NATURE® (MALTA ORGANICA DE AVENA)

Añadir al carrito

MALT CHÂTEAU OAT NATURE® (MALTA ORGANICA DE AVENA)

Añadir al carrito

-

CHÂTEAU CARA BLOND NATURE (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA BLOND NATURE (MALTA ORGÁNICA)

Añadir al carrito

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

CC26 mm, Rose with silver edge (10500/caja)

Añadir al carrito

CC26 mm, Rose with silver edge (10500/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 1485 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 1485 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

-

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

Canada: Lower area and yields drop barley production by 12% for the 2006/07 crop year

Canada: Lower area and yields drop barley production by 12% for the 2006/07 crop year

Agriculture and Agri-Food Canada (AAFC) has released June 27 its Grain and Oilseed outlook. Accordingly, barley production is forecasted to decrease by 12% due to lower area and yields. Lower carryin stocks will also contribute to a 13% decrease in supply. Exports are forecast to decrease by 19%, as lower feed barley exports are only partially offset by higher exports of malting barley.

Despite lower exports and domestic feed use, carry-out stocks are forecast to fall significantly. The average off-Board feed barley price (No.1 CW, instore Lethbridge) is forecast to increase by $20/t from 2005-06 to $130/t (all figures in CA$). The CWB PRO for No. 1 CW feed barley for Pool A in 2006-07 is $113/t, vs. $122/t for Pool B in 2005-06. The CWB PRO for SS2R malting barley is $161/t vs. $170/t for 2005-06, due to strong export competition from Australia.

AAFC forecasts that total production of grains and oilseeds in Canada will decline by 6% from 2005-06, to 63 million t (Mt), above the 10-year average of about 60 Mt. In western Canada, production is forecast to decline by 7%, to 47.3 Mt, with eastern Canadian production down by 2%, at 15.5 Mt. Exports and domestic use are expected to increase in 2006-07. Non-durum wheat, canola, feed barley and corn prices are expected to increase from 2005-06, while durum, oat, flaxseed and soybean prices are expected to decrease. Prices will continue to be pressured by the strong Canadian dollar. The major factors to watch are: growing conditions in the US corn belt, US and Canadian spring wheat crop conditions, the biofuel market, ocean freight rates and the Canada/US exchange rate.

Regresar

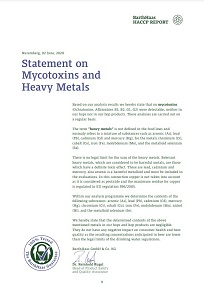

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

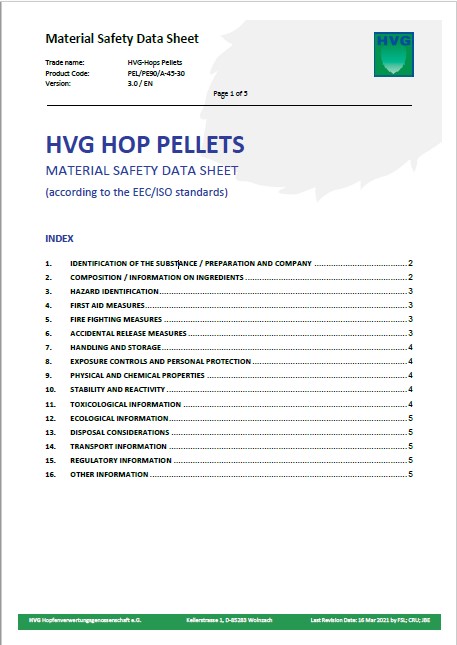

Hops, HVG, Material Safety Data Sheet 2023

Hops, HVG, Material Safety Data Sheet 2023

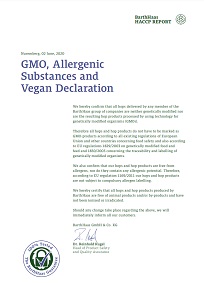

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Malt GMO-Free Certificate 2025

Malt GMO-Free Certificate 2025

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027