Tu carrito

Noticias de Empresa

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

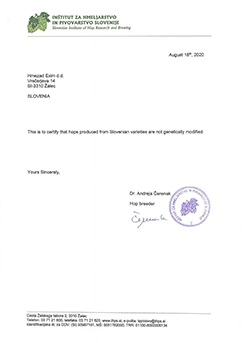

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

-

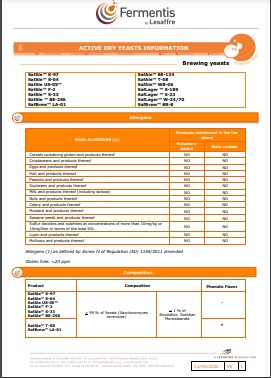

Fermentis - Brewing Yeasts Information 2023

Fermentis - Brewing Yeasts Information 2023

-

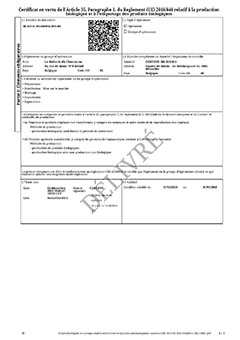

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Sugerencia

Australia: C&T Malt Company is up for sale

Australia: C&T Malt Company is up for sale

One of the world's largest malt producers, with extensive Australian operations, is up for sale with a $US300 million tag. C&T Malt, a joint venture between US food company ConAgra Foods and South African branded food and healthcare company Tiger Brands, is being offered to potential buyers. C&T Malt supplies all of CUB's malt in Australia under a long-term contract, The Herald Sun reported on April 19.

It also supplies malt to Budweiser producer Anheuser Busch, SABMiller, Scottish & Newcastle, Coors and Belgium brewer InBev. The jewel in C&T's crown is its Australian operations, the Richmond-based malting outfit Barrett Burston.

The company runs plants in Geelong and Burnley, Toowoomba in Queensland and Thornleigh in New South Wales. It also owns 10 other malting plants in Britain and Canada.

It is believed that rural services provider Elders and private equity firm Castle Harlan Australian Mezzanine Partners have recently taken a look at the business. Spokesmen for Futuris -- Elders' parent company -- and CHAMP would not comment.

It is believed that Tiger wants to exit the commodities market and expand further into branded foods. Tiger Brands boss Noel Boyle would not respond specifically to emailed questions from BusinessDaily regarding a sale of C&T Malt.

"We have no comment other than that in our annual report," he said in an email. The company's most recent annual report says: "Tiger's investments in C&T Malt (50 per cent shareholding) . . . (are) regarded as non-core and will be disposed of in due course."

Analysts said an agribusiness such as Elders or AWB's Landmark was a logical buyer of a malting company as it would allow them to make money on either side of the supply chain.

On one hand, the business sells inputs to farmers for grain growing. It can then match the output, the crop, with a buyer, such as its own malting company. Other parties that would logically run the ruler over C&T Malt include stockfeed producer Ridley Corporation and ABB Grain, which already owns Joe White Maltings.

The world's top two malt producers - Groupe Soufflet and Cargill - would also be logical suitors.

Regresar