Tu carrito

Noticias de Empresa

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

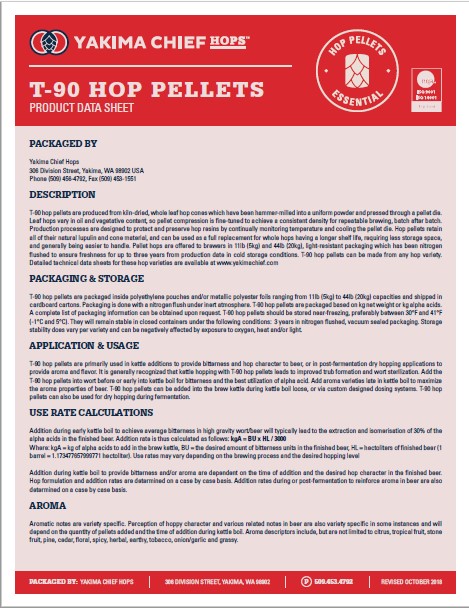

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet

-

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

-

Barth Haas Hops: EU Food Safety Declaration 2022

Barth Haas Hops: EU Food Safety Declaration 2022

Sugerencia

Germany: Expected beer sales boom during Euro 2024 failed to materialize - Veltins brewery

Germany: Expected beer sales boom during Euro 2024 failed to materialize - Veltins brewery

A major German brewery on July 12 reported disappointing figures for the beer industry in June.

An expected boom in consumption during the men’s UEFA European Championships failed to materialise.

Veltins representative Michael Huber said the “European Championship effect has flopped for the breweries,“ as rainy weather and a change in drinking habits dampened sales despite Germany hosting the tournament.

The brewery said German drinkers consumed an estimated eight million hectolitres of beer in June, lower than in the same month in 2023. One hectolitre is 100 litres.

German breweries sell around one-sixth of their beer to the hospitality sector, with the lion’s share of their business coming from the retail trade.

According to Veltins, consumers in supermarkets and beverage stores have held back this year.

The comparison with the “summer fairytale” of 2006, when Germany hosted the men’s FIFA World Cup, is sobering.

Beer sales in June of that year were reportedly around 11 million hectolitres. During this year’s tournament, fans have watched more games alone at home, instead of meeting up in large numbers and drinking more heavily.

“That’s different from inviting your neighbour over for a barbecue and drinking beer,“ Mr Huber said.

To calculate the figures, Veltins used data from a logistics company it partly owns and other market estimates.

The brewery, based in the western German state of Saarland, on Friday, presented figures showing that it sold four per cent more beer in the first half of 2024.

Nevertheless, the business with 721 employees – recorded a loss in June.

These major German competitors include the Oetker subsidiary Radeberger and Oettinger, Bitburger and Warsteiner.

Regresar