Tu carrito

Noticias de Empresa

E-Malt news

France: Beer and wine conglomerate Castel Group facing internal turmoil

UK: Spring barley area forecast to drop by 15% in 2026

Australia: Barley prices beginning to stabilize after four years of declines

EU: Early barley crop 2026 picture remains good, forecast for 2025 boosted by 0.2 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Rojas 102 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 102 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Marron 141 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Marron 141 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Crown Caps 26 mm TFS-PVC Free, Dark Brown col. 2844 (10000/caja)

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Dark Brown col. 2844 (10000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

Cote d�Ivoire: Castel�s subsidiary SOLIBRA reports robust growth in FY2023 net profit

Cote d�Ivoire: Castel�s subsidiary SOLIBRA reports robust growth in FY2023 net profit

Société de Limonaderies et de Boissons Rafraîchissantes d'Afrique (SOLIBRA), a subsidiary of the French group Castel with a 76.8% stake held by BGI, announced a net profit of CFA15 billion (around $24.69 million) for FY2023. This represents a robust growth of 1,139% compared to 2022, when the company reported a profit of CFA1.2 billion, Ecofin Agency reported on May 14.

The strong performance was driven by an increase in sales. After a decline in 2022, revenue rebounded, reaching a record high of CFA311.4 billion. This momentum helped offset a CFA23.3 billion increase in cost of sales compared to the previous year.

Moreover, a decrease in depreciation and amortization charges, as well as relatively stable financial expenses, allowed the company to achieve further margin gains. As a result, Solibra was able to close 2023 with a pre-tax profit of CFA11.3 billion, compared to approximately CFA3 billion in 2022. However, what truly propelled the growth in net profit was the level of non-operating income.

Solibra did not specify the composition of these non-operating activities, but in 2023, their contribution to the brewer's revenue was CFA7.5 billion. This is significantly higher than the total performance for this indicator since 2014, according to data compiled by Ecofin Agency. This year, Solibra announced dividends for its shareholders, including an 18.6% free float. However, according to the financial information platform Richbourse, "the very low dividend yield (3.24%) could cool investors". Additionally, Solibra will need to present more reliable indicators to its investors.

The company will need to ensure that net profit continues to grow in a market that has become more competitive with the arrival of Brassivoire, an alliance between the distribution specialist CFAO and the Dutch group Heineken. Furthermore, despite a price increase in 2024, the purchasing power of Ivorians continues to decline, weighed down by higher energy, food, and transportation bills. However, an increase in sales can be expected in the first quarter due to the effect of the Africa Cup of Nations football tournament.

Regresar

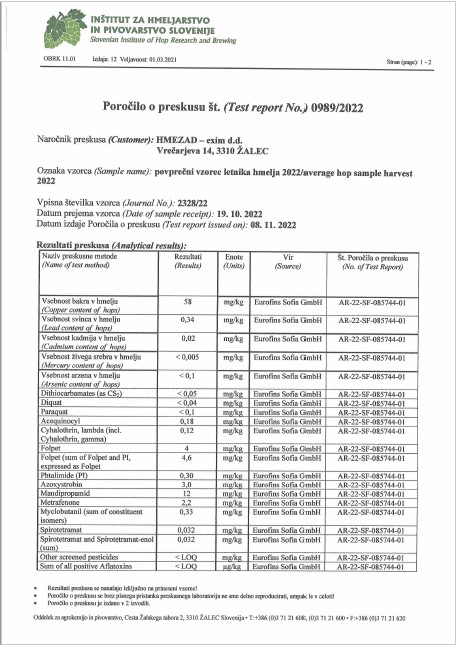

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022

Organic Rice Husk Certificate ENG - 2023 - 2025

Organic Rice Husk Certificate ENG - 2023 - 2025

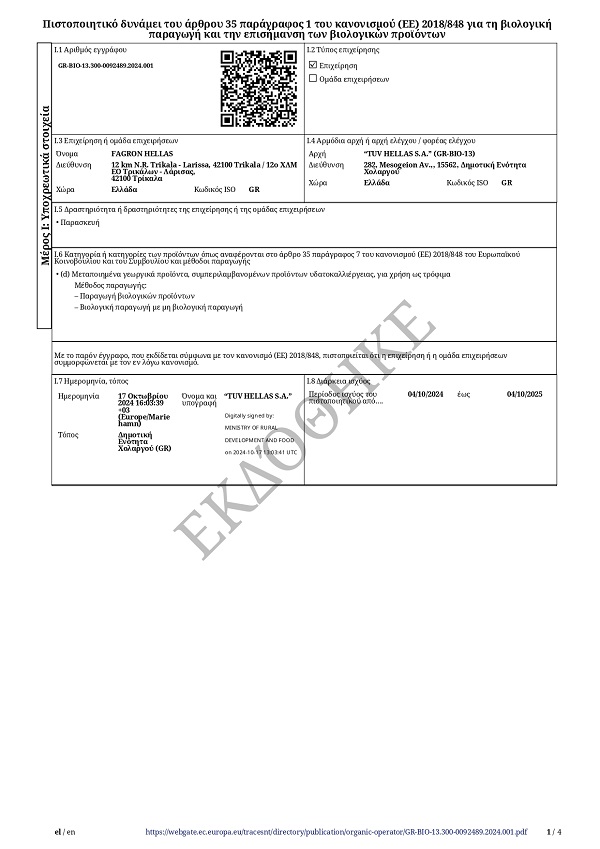

Fagron Spices, Organic Certificate 2024 - 2025

Fagron Spices, Organic Certificate 2024 - 2025

Crown Caps Finnkorkki Statement

Crown Caps Finnkorkki Statement

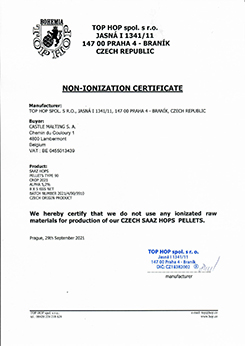

Top Hop - Non Ionization Certificate 2021

Top Hop - Non Ionization Certificate 2021