Noticias de Empresa

E-Malt news

Canada, ON: Workers reach final deal as Diageo closes Crown Royal plant in Amherstburg

Australia: ABAREs lifts forecast for wheat, barley, canola crops

USA, WI: Nicolet Ale Works to move into a permanent new home

Pakistan: Murree Brewery restarts beer exports for the first time since prohibition imposed in 1977

Nuestras maltas

-

CHÂTEAU CHOCOLAT NATURE® (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CHOCOLAT NATURE® (MALTA ORGÁNICA)

Añadir al carrito

-

CHÂTEAU CHIT BARLEY NATURE MALT FLAKES® (MALTA ORGANICA DE CEBADA EN COPOS)

Añadir al carrito

CHÂTEAU CHIT BARLEY NATURE MALT FLAKES® (MALTA ORGANICA DE CEBADA EN COPOS)

Añadir al carrito

-

CHÂTEAU CARA CAFÉ®

Añadir al carrito

CHÂTEAU CARA CAFÉ®

Añadir al carrito

-

CHÂTEAU WHEAT BLANC NATURE(MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU WHEAT BLANC NATURE(MALTA ORGÁNICA)

Añadir al carrito

-

CHÂTEAU CRYSTAL NATURE (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CRYSTAL NATURE (MALTA ORGÁNICA)

Añadir al carrito

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Purple Opaque col. 2274 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Purple Opaque col. 2274 (10000/caja)

Añadir al carrito

-

Crown Caps 29mm TP-PVC Free, Gold NEU col.4310 (6500/box)

Añadir al carrito

Crown Caps 29mm TP-PVC Free, Gold NEU col.4310 (6500/box)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 1485 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 1485 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 74 mm, Azules 141 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Azules 141 Flatfitting A-type (700/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

EU & UK: Finland, Ireland and the UK highest beer taxing countries in Europe

EU & UK: Finland, Ireland and the UK highest beer taxing countries in Europe

According to EU law, every EU country is required to levy an excise duty on beer of at least €1.87 per 100 litres (26.4 gal) and degree of alcohol content, translating to approximately €0.03 per 330ml (11.2 oz) beer bottle at 5% abv. However, only a few EU countries stick close to the minimum rate; most levy on much higher excise duties, according to a recent study by the Tax Foundation.

Finland, Ireland, and the United Kingdom are the three countries covered that levy the highest excise duties on beer in Europe. Finland has the highest excise tax on beer in Europe at €0.63 per 330ml beer bottle. Ireland and the United Kingdom are second and third, at €0.37 and €0.35, respectively.

Bulgaria, Germany, Luxembourg, Romania, and Spain are the countries levying approximately the EU’s minimum rate of €0.03 per beer bottle.

Regresar

La Malterie du Chateau | FCA Malt Certificate (English) (2024-2027)

La Malterie du Chateau | FCA Malt Certificate (English) (2024-2027)

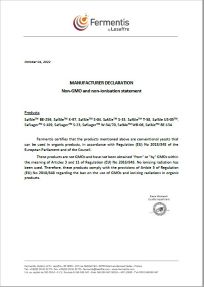

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

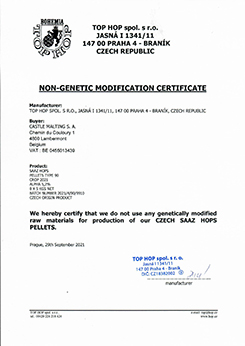

Top Hop - Non GMO Certificate 2021

Top Hop - Non GMO Certificate 2021

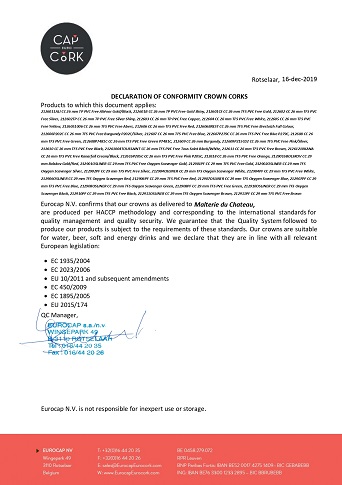

Crown Cork EUROCAP Conformity Certificate 2019

Crown Cork EUROCAP Conformity Certificate 2019

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2