Tu carrito

Noticias de Empresa

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

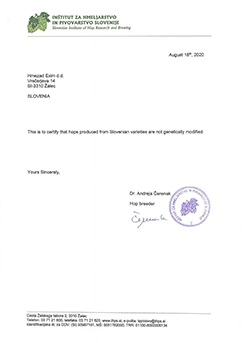

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

-

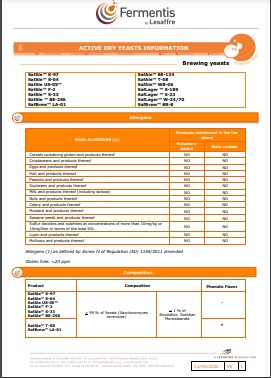

Fermentis - Brewing Yeasts Information 2023

Fermentis - Brewing Yeasts Information 2023

-

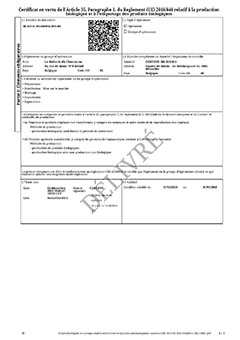

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Sugerencia

Argentina: Barley crop forecast unchanged at 5 mln tonnes

Argentina: Barley crop forecast unchanged at 5 mln tonnes

The moisture situation across Buenos Aires Province has improved, and more rain is forecast this week. Cool temperatures over the past month did not cause any frost damage, but has led to a more shallow early root development. As warmer temperatures arrive, the root development is expected to catch-up, RMI Analytics said in their latest report.

Barley crop ratings are 84% Good & Excellent, which puts the crop on a positive path at this early stage and RMI’s barley crop’24 production estimate for Argentina remains at 5.0 mln tonnes due to this positive crop view.

In a very quiet market, prices continue to drift lower, as buyers’ price ideas remain at lower levels and an absence of farmer selling creates a continued liquidity vacuum. There is more price weakness in Feed/FAQ barley as the likelihood for China to continue high volumes of Argentine barley are reduced, due to Australia re-taking a majority market position. The main reason farmers are unwilling to sell, centres upon the expectation the Government will unify exchange rates (official/unofficial) and also reduce or eliminate export taxes. This leaves ~2.0 mln tonnes of crop’23 unsold/unpriced, along with ~4.5 mln of crop’24. Eventually, this barley must come to market, and potentially is bearish, depending on the timing. Without malting demand, increased feed markets (e.g. Saudi) would be targeted, the analysts said.

Regresar